|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

The Best Way to Refinance Your Home: A Comprehensive GuideRefinancing your home can be a strategic financial move, but it's essential to understand the best way to approach it. This guide will explore various methods and considerations to help you make an informed decision. Understanding Home RefinancingRefinancing involves replacing your existing mortgage with a new one, often to secure better terms. The primary goals are usually to lower interest rates, reduce monthly payments, or change loan types. Steps to Refinance Your Home1. Assess Your Financial SituationBefore proceeding, evaluate your current financial status. Ensure that your credit score is in good shape, as this will influence the rates you're offered. 2. Explore Different Loan OptionsConsider different loan types such as fha loan refinance streamline if you're looking for a faster process with less paperwork.

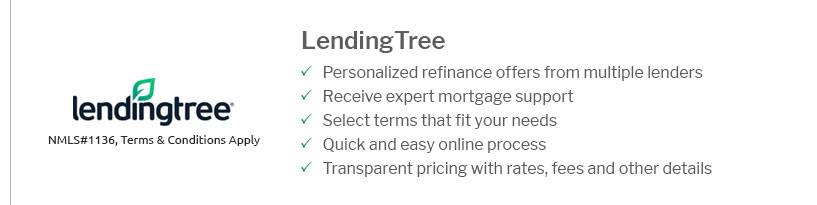

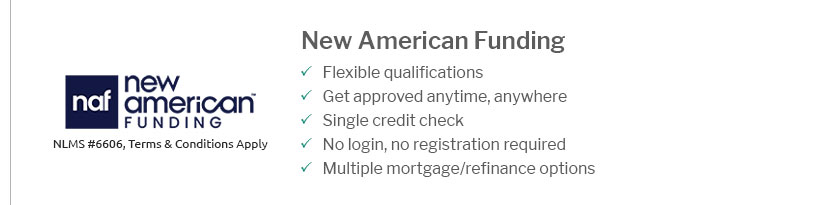

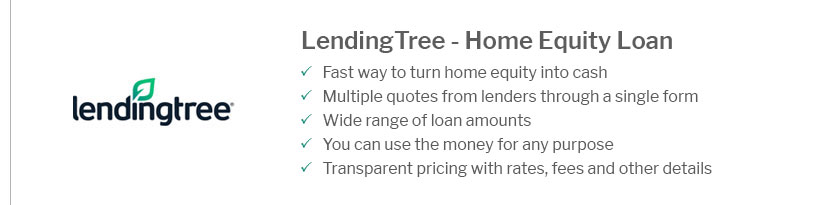

3. Shop for LendersIt's crucial to compare offers from multiple lenders. Look for the best interest rates and terms that suit your financial goals. 4. Apply for RefinancingOnce you've chosen a lender, submit your application. Be prepared to provide financial documents like tax returns and pay stubs. 5. Close the LoanAfter approval, you'll move forward with closing the loan. Ensure you understand all terms before signing the agreement. Benefits of RefinancingRefinancing can offer numerous advantages, such as lowering your monthly payments, shortening your loan term, or switching to a more favorable interest rate.

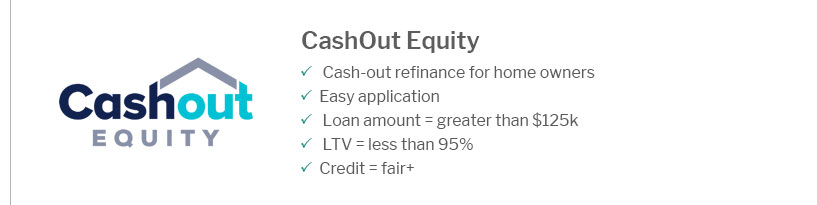

Consider an fha loan to conventional loan refinance if you're aiming for long-term savings and stability. Potential RisksWhile refinancing offers benefits, it's not without risks. Be mindful of potential pitfalls such as prepayment penalties or closing costs that could outweigh the savings. FAQhttps://www.bankrate.com/mortgages/low-cost-refinance/

Build your savings. Add to your savings whenever possible. With more savings, you might be seen as less of a risk and score better rates as a ... https://www.youtube.com/watch?v=cyOla5wioac

... you're in a state I'm not licensed in, I can advise you on what to do/say to get the best deal. If you are working with me, after sending in ... https://money.usnews.com/loans/mortgages/articles/how-to-refinance-your-mortgage

First, Set a Refinancing Goal - Compare Top Mortgage Lenders - Shop Around to Compare Mortgage Rates and Terms - Formally Apply Through the Lender ...

|

|---|